Global wealth is growing again – and becoming ever more mobile. The globalisation of residency is not a new phenomenon among the world’s wealthiest families and individuals, but it has been accelerated by myriad factors, including shifting tax regimes, climate change and competition for wealth and talent. Thus, the traditional hierarchy of primary, secondary or vacation residences makes way for a more nimble, nomadic and seasonal approach.

The inaugural Savills Spotlight on Wealth Trends report highlights the factors shaping the prime global real estate market. As Victoria Garrett, head of global residential (excluding UK), explains: “Our clients are not defined by borders.”

After a dip in 2022, more than 680,000 people became new dollar millionaires in 2024, and five million more are expected to join them by 2029. Meanwhile, the wealth of billionaires has increased by a remarkable 121% over the past 10 years, as ultra-high-net-wealth individuals benefit from increasing innovation, rising asset values and the boom in alternative investments such as cryptocurrency.

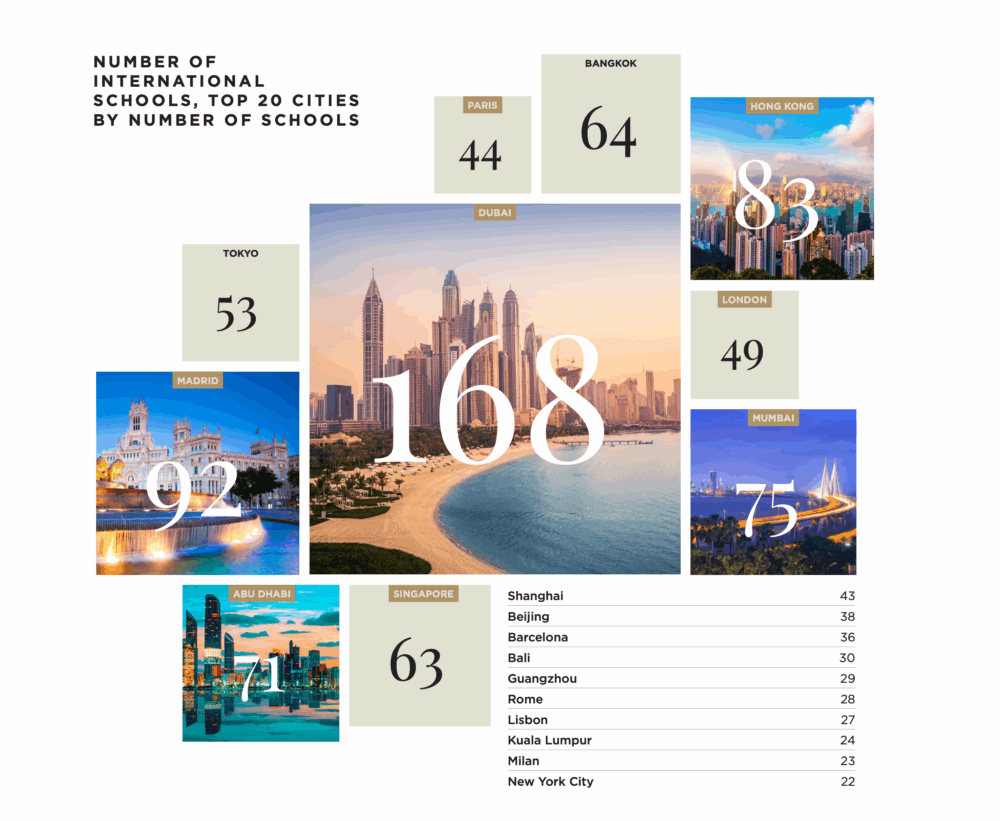

UHNW property remains an essential part of wealth portfolios, but individuals today are seeking more than a place that will hold its value. They are drawn to locations that suit their work schedules, lifestyles, family needs and wealth management priorities – from global cities such as Dubai, New York, Singapore and London to coastal and ski locations including Monaco, Miami and Aspen. Security and health are also increasingly important.